I’ve had the pleasure of watching David Chilton speak in person at the Vancouver Investors Forum in November of 2012. For those of you who don’t know David, he is the new Dragon on CBC’s hit TV show, Dragon’s Den, and the best-selling author of “The Wealthy Barber”.

I’ve had the pleasure of watching David Chilton speak in person at the Vancouver Investors Forum in November of 2012. For those of you who don’t know David, he is the new Dragon on CBC’s hit TV show, Dragon’s Den, and the best-selling author of “The Wealthy Barber”.

At the end of his speaking engagement, David was kind enough to give us a copy of his latest book, “The Wealthy Barber Returns”. He even talked to us for a few minutes while he signed our books. My impression of David was that he’s a smart and conservative guy who is very knowledgeable about the stock market, investing and saving money.

A few weeks after meeting David, I started reading “The Wealthy Barber Returns” and I must say that I enjoyed the book more than I thought I would. It was an easy read, contained a few chapters that made me laugh and provided a few useful money-saving tips. I completely agree with David’s money-saving ideas and have actually adopted a few of them myself, however most of his book is based on the concepts of “saving up to buy RRSP’s for retirement” and “paying off your principal residence ASAP”. I completely disagree here as David Chilton seems to forget about the opportunity to build wealth through real estate.

(Don’t) Save to Buy RRSP’s for Retirement

The most common RRSP investment products are GIC’s, mutual funds, and stocks. Yes, GIC’s are guaranteed, but they pay extremely low interest rates that barely keep up with inflation. Also, when you invest in mutual funds and stocks, there are no guarantees that you will make money or even retain your principal. Both of these latter investment options give you a highly unpredictable return.

My philosophy is save your money to buy multiple investment properties. When you retire, this option can provide you with monthly passive income so you CAN stop working. You also have the option of selling each property as you need the money. Here are some of the other advantages of investment properties you won’t get with traditional investments:

Leverage. When you purchase an investment property, the minimum down payment is 20% of the purchase price, providing you get approved for the mortgage, the bank will loan you the other 80%. For example if you buy a property worth $200,000, your down payment would be $40,000 and the bank will finance $160,000. Therefore, for a low $40,000 you could own a property worth $200,000. – NICE!

Using Other People’s Money. Providing your property receives positive cash flow (monthly rent collected is higher than monthly expenses) your tenants are paying down your mortgage, your property taxes, your maintenance fees (if strata present), your property management fees (if you don’t manage it yourself), your insurance and all other related monthly expenses! AND you will receive some extra cash or passive income each month. – EVEN NICER!

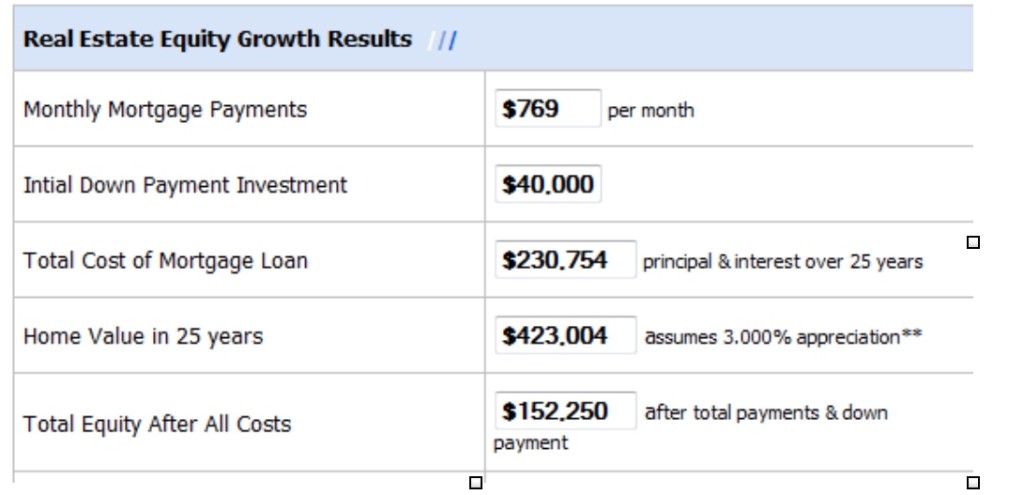

Instant Equity. For the $200,000 property, if it appreciates even at a modest rate of 3% per year, in 25 years time, your $40,000 down payment would then become $423,004 (see table below). Your equity would be $152,250 and your total return on investment after 25 years would be 1057% ($423,004/$40,000). This is not a typo; your profit would be over 10 times over your original investment of $40,000. Now, imagine having 4-5 or more of these babies? – CHA-CHING!

(Don’t) Pay off your principal residence ASAP

A method that sophisticated investors use to expedite the growth of their investment portfolio is to USE the equity in their primary residence towards the down-payment of their investment properties. You achieve this by applying for a Home Equity Line of Credit or HELOC from your bank.

From there, you re-finance your investment properties every 5 years to draw out the equity to buy more investment properties. Why do you do this?

Dead money. Equity sitting in your home doesn’t do anything for you; in other words, your money cannot grow there.

Smart money. This is very much like how compound interest works, but at a much larger scale as there are now 3 income centres 1) positive monthly cash flow 2) mortgage pay down by tenants 3) capital appreciation. The first two you can control, the third is unpredictable, however, we know from history that real estate has doubled in value every 20 years. As a bonus, the interest borrowed from your home equity loan are considered to be business expenses since it is borrowed to generate income.

My Recommendation: The sad reality is that most people have to forget freedom 55. Most people will be achieving freedom 75, freedom 85 or no freedom at all. The reason- people just don’t have enough monthly passive income if they stopped working and most of the traditional ‘safe’ investments like GIC’s barely even keep up with inflation. Real estate investing is simple. The buy and hold strategy of real estate investing requires patience and endurance. It will not make you rich quickly. However, through the 3 income centres of cashflow, mortgage pay down, and appreciation, combined with ‘compounding’ your investment properties over time, real estate will get you rich FOR SURE. So David Chilton, care to write your next book with me? Let’s call it “The Wealthy Barber Returns Even Wealthier”.

– by Teresa Leung

If you like this post, please comment below and feel free to share it with friends and colleagues. www.pointbinvestment.ca