by Teresa Leung | Sep 21, 2018 | Real Estate Investing Tips, Uncategorized

With recent news headlines such as “Housing prices in Vancouver dropping due to greater supply,” “B.C. residential sales decline,” and “B.C. residential real estate downturn largely behind us,” I bet you’re all rather confused as to what’s going on in the real estate market. So what is the new reality for real estate in Metro Vancouver and Fraser Valley?

The Metro Vancouver housing market continues to experience reduced demand across all housing types. To start, there are now fewer multiple offer presentations, and sellers have also become more flexible with both selling terms and price. Because of this, it is now the norm for buyers to take their sweet time during their purchasing process by considering multiple properties simultaneously, followed by negotiating relentlessly on a deal over a series of offers and counter-offers.

The Real Estate Board of Greater Vancouver (REBGV) reported the number of residential home sales in the region totalling to 1,929 in August 2018; a 36.6 percent decrease from the 3,043 sales recorded in August 2017 – additionally, there was also a 6.8 percent decline in home sales compared to July 2018 where 2,070 homes were sold. Moreover, last month’s sales hit an all-time-low: sales fell by 25.2 percent below the standard 10-year August sales average.

Similarly, the Fraser Valley Real Estate Board reported 1,155 sales of all property types on its Multiple Listing Service® (MLS®) in August; indicating a decrease of 38.5 percent compared to the 1,879 sales in the previous August, there was also a 10.5 percent decrease in sales compared to the 1,290 sales made in July 2018.

Sales of attached homes continue to represent over fifty percent of all real-estate transactions in the Fraser Valley as of August – where a total of 294 townhouses and 318 apartments were sold.

Many Sellers are pricing their properties much lower than they would have a year ago, close to 2017’s assessed values. I’ve seen some sellers even selling their homes under assessed values, as it’s forecasted that 2018’s assessments will stay the same or will be slightly lower than the previous year’s. Not that assessed values are market value, but prospective Buyers do use assessed values as a benchmark of what they should offer. As a Seller, effective pricing is key and will ultimately be your determining factor in a successful transaction.

For Investors, it’s officially a prime time to bid lower offers that go hand-in-hand with favourable terms such as financing approval, inspection and approval of strata documents. Moreover, we also have the ability to show the property to prospective tenants prior to completion date…and the craziest thing is among all these factors, we’re still able to have our offers accepted!

As of September 17, 2018, there are 83 brand new listed one and two bedroom condo’s under $400,000 for sale in the Metro Vancouver and Fraser Valley region. In the month of August – only five of these units sold; with such a low absorption rate, the tables have finally turned as it has now become a buyer dominant market: at least for now, that is…hooray, while it lasts!

If you are thinking of selling your investment in Greater Vancouver or anywhere else in BC, please contact us at teresa@pointbinvestment.ca or at (604)618-2128.

by Teresa Leung | May 31, 2018 | Real Estate Investing Tips, Uncategorized

Often, my investor clients ask, “when it is the right time to sell”? My usual response is to advise against selling an investment property as the investor would need to pay capital gains tax. As opposed to selling the property outright, I suggest re-financing every 3-5 years to take out the equity to re-invest into other properties or to repay loans and lines of credit.

However, I do recommend selling the property in exceptional circumstances such as the following:

1. When the property unit is in a condominium older than 15 years – in BC, the strata corporations rarely charge enough condo fees resulting in special assessments; these assessments are usually major projects such as building envelopes, exterior painting, roof replacements etc. More often than not, these assessments will eat into your profits. Therefore, I advise that when your condo reaches its 10-year mark, to renew the mortgage with a variable rate where the penalty for breaking the terms is just 3 months’ worth of interest as opposed to a fixed term with hefty penalties. I’ve had to break a fixed 5-year mortgage with one of the Big Five Banks where the penalty was $24,000 – thankfully though, I bought a new property and was able to transfer that mortgage with the penalty being waived. Bottom point: I would sell when the condo is between 10-15 years old.

2. When the property is located in an area where population or job growth is declining. As investors, it is important to realize that the future of our real estate’s return on investment is highly dependent on the growth of jobs and population in the located area. As that thrives, the more valuable the property becomes. Comparatively, when the opposite happens, real estate prices decrease. It is wise to sell the property before we hear of a continued amount of job decreases and people moving away from the area in search of new occupations. That said, it is vital to remain up-to-date with the market(s) we’re investing in, and to really talk to the locals who live in that area and to sell before market downturns.

3. When you make over a 75% ROI (return on investment).

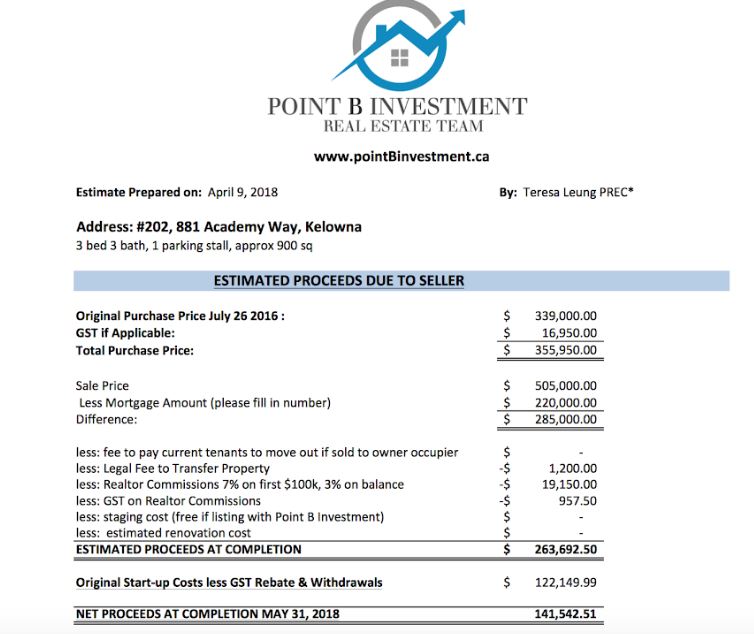

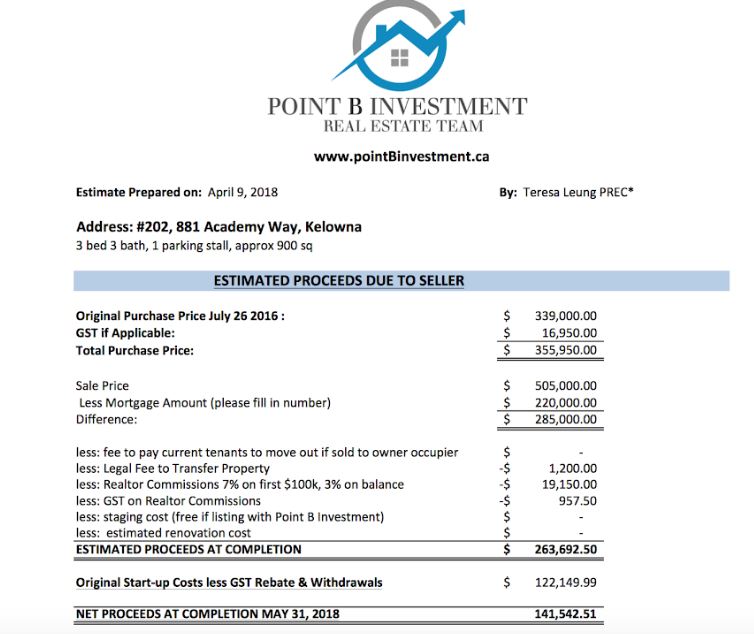

For example, in July 2016, nearly two years ago, I purchased a 3 Bedroom condo for $339,000 plus GST. It is located in the U-District of Kelowna, a five-minute walk across the Okanagan campus of the University of British Columbia. My initial cost for the property was $122,000 – which included my down payment, closing fees, and furnishings. Fast forward 22 months later, I sold the property for $505,000 (furniture included); the profit I received was $141,542 after paying off the mortgage, realtor fees, and closing costs – in other words, I made a 116% ROI all within this time span. It was a tough decision as my cash-flow was over $400/mth during the school year and up to $3000/mth during summertime. However, as great of an investment it was, I sold the property because I knew of more student rentals being built in the area, with many pending completion in one to two years from now. I also knew of the BC Government’s plan to create 5000 student rentals across BC, announced in the 2018 budget plan where they will dedicate increased spending on. Simply put, that meant more competition for student tenants, inevitably leading to me having to reduce my rental rates to compete and so I chose to exit the U-District area while it is still opportune.

As previously mentioned, it is essential to educate ourselves on the local market and upcoming changes that may affect real estate investment prices. It especially is useful when you also follow the 75% ROI Rule.

If you are thinking of selling your investment in Kelowna or anywhere else in BC, please contact us at teresa@pointbinvestment.ca or at (604)618-2128,

by Teresa Leung | Dec 7, 2017 | Real Estate Investing Tips, Uncategorized

In October 2017, the Bank of Canada announced that new mortgage rules will be taking place beginning Jan 1, 2018. This will drastically affect borrowers if they are currently putting a minimum of 20% towards their down payment as of right now as they are enjoying the benefits of qualifying for the lower rate of their mortgage contract. As of next year, it will become mandatory for borrowers to qualify for a greater benchmark rate either at 4.99% or their contact rate with an additional two percent on top – therefore reducing the amount you can borrow by around 20%.

For example, if buyers currently qualify to be a in fixed term mortgage contract at a discounted rate of 3.14%, under the new rules they would have to add an additional 2%, thereby, they would have to qualify at a rate of 5.14%.

Borrowers however may be able to be exempt from the new mortgage rules should they either:

- renew their current mortgage with their existing lender where their amortization period stay the same and where no additional funds advance;

- if they purchase a property before the new rules take into effect (completion can be in the new year);

- if they get a mortgage with credit unions such as Coast Capital or Vancity due to the fact that they are not federally regulated banks, and as of this writing, only federally regulated banks are affected by this new rule.

With that being said, it is important that as real estate investors you understand how the new mortgage rules taking place will affect you so you can prepare for any changes ahead of time. Happy mortgage shopping!