by Teresa Leung | Aug 1, 2018 | Real Estate Investing Tips

It appears that the rate of pre-sale condos and townhouses being sold now are steadily declining across the Lower Mainland and the Fraser Valley, with Downtown Vancouver being affected the most.

According to a mid-year report published by MLA Canada, a real estate marketing agency, the sales rate of pre-sale units as of June 2018 was at 50 per cent; this is a drastic difference compared to the 94 per cent pre-sale sales rate seen earlier in January this year.

Overall, 74 per cent of the 7,753 pre-sale units were sold from January to June – though indeed a more modest pace of sales, this stabilization in prices should be good news for homebuyers and the real estate market.

From what once used to be more of an unsustainable, hyperactive market, things are now normalizing and becoming more balanced; this “ensures more modest and realistic price growth, more choice for consumers and the need for higher quality product from the industry,” said Suzana Goncalves, chief advisory officer and partner at MLA Canada.

Local Market Divergence

Despite there being a steady decline of pre-sales in most of the Lower Mainland, Burnaby North, however, experienced a sold-out rate of 91 per cent from January to June 2018 for the 1,600 new homes that were released. In addition to Burnaby North, MLA’s report also indicated strong pre-sale activity in the New Westminster, West Coquitlam and North Surrey area. This contrasts with the City of Vancouver as they only saw 61 per cent pre-sales in East Vancouver, 54 per cent on the West Side, and 34 per cent in Downtown – all of which make sense as more people are seeking more affordable options with potentially higher property appreciation levels. Nonetheless, Port Coquitlam hit an even lower rate at 19 per cent between January to June, with Richmond followed by a 39 per cent purchasing rate.

Investors Selling Assignments

As new home pre-sales continue to plummet, more and more pre-sale buyers are trying to assign (re-sell) their pre-sale contract. As of July 18th, 587 pre-sale condos were being listed for sale from Squamish all the way to Langley on Craigslist, Kijiji, and through various real estate agents’s websites.

As MLA expects to see 67 more housing projects, and approximately 7,700 new homes launching between now to the end of 2018, we at Point B Investment expect to see pre-sales continue to plummet… which is great news for us, as real estate investors, we buy when others are fearful! We anticipate to see some pre-sale deals coming this Fall and Winter and will advise you accordingly!

by Teresa Leung | Jul 9, 2018 | Real Estate Investing Tips

There’s been endless news articles during the past year talking about the Vancouver real estate market and if the bubble will pop anytime soon. Of course, none of us have a crystal ball to foresee the future, but as a real estate agent and investor who is very active in the housing market, this is what I see happening currently.

1. Mortgage Rates Increase & Stress Test. Interest rates are gradually increasing and they are predicted to increase even more by the end of July and again before the end of 2018. In addition to the increase in rates, people who had an accepted contract after Jan 1, 2018 were required to qualify at 2% more than what their actual mortgage rates are, thus allowing Buyers to qualify for about 20% less than if they purchased before January 1st. Many Buyers just simply cannot qualify any longer to purchase a home that they want and it’s predicted that some people who have purchased a pre-sale property may not be able to get a mortgage at completion which is a date in the future.

2. Historic Appreciation. Real estate prices appreciated at historic levels in 2016 and 2017, as much as 30% per year in both Metro Vancouver and in Fraser Valley. This growth cannot be sustainable, and we are seeing a drastic slow-down in the market today with single-family homes actually depreciating anywhere from 10-25% in value from last year.

3. Reduced Foreign Buyers. Since August 2016, the BC government introduced a slew of taxes like the Foreign Buyer’s tax, Empty homes tax, Speculation Tax, increased Property Transfer Tax for properties over $2M, increased school tax for properties over $3M, just to name a few. It seems the BC government is penalizing foreigners and as a result, we are seeing much less foreign buyers these days.

4. End of the Bidding Wars. All through 2016, 2017, and from January to April 2018, it was common to witness multiple offers, with people bidding in some cases hundreds of thousands above the asking price with subject-free offers on properties. Today, we see the opposite: buyers are now able to negotiate on the asking prices and to put in the appropriate subject clauses to protect their interests. What used to be a platform for sellers to capitalize on their financial gains from appreciating properties has now become an opportune market for buyers, especially in the detached market.

5. Pre-Sale Condo’s and Townhouses Line-ups. Though the condo & townhouse market is still strong, we are not seeing long, frenzy line-ups at pre-sale projects today, especially in the Fraser Valley. There are select projects in Vancouver, Burnaby and Coquitlam that are selling well, but there is definitely a slow-down for pre-sale purchases. We’re seeing developers offer incentives such as 5% down payment only, 0% assignment fees, and increased REALTOR® commissions to name a few.

In addition to these 5 factors, according to the Vancouver Real Estate Board, residential home sales totalled 2425 in June 2018 a 37.7% decline from 3,893 sales recorded June 2017 and 14.4% decrease compared to May 2018.

June’s sales were 28.7% below the 10-year June sales average. The total number of homes currently listed for sale on the MLS in Metro Vancouver is 11,947, a 40.3% increase compared to June 2017 (8515). Sales to active listings ratio for June 2018 is 20.3%. Which means of all the active listings, just over 20% got sold.

I am predicting that prices will continue to decline in the detached market, and that condos and townhouses will remain flat for the remainder of 2018. Will we have a market crash? We have yet to find out.

For condo and townhouse owners, I feel this will be your last chance at selling to capture the crazy high appreciations we have had, and for all us investors, I suggest we sit tight for the rest of this year and scoop up the bargains come 2019.

by Teresa Leung | May 31, 2018 | Real Estate Investing Tips, Uncategorized

Often, my investor clients ask, “when it is the right time to sell”? My usual response is to advise against selling an investment property as the investor would need to pay capital gains tax. As opposed to selling the property outright, I suggest re-financing every 3-5 years to take out the equity to re-invest into other properties or to repay loans and lines of credit.

However, I do recommend selling the property in exceptional circumstances such as the following:

1. When the property unit is in a condominium older than 15 years – in BC, the strata corporations rarely charge enough condo fees resulting in special assessments; these assessments are usually major projects such as building envelopes, exterior painting, roof replacements etc. More often than not, these assessments will eat into your profits. Therefore, I advise that when your condo reaches its 10-year mark, to renew the mortgage with a variable rate where the penalty for breaking the terms is just 3 months’ worth of interest as opposed to a fixed term with hefty penalties. I’ve had to break a fixed 5-year mortgage with one of the Big Five Banks where the penalty was $24,000 – thankfully though, I bought a new property and was able to transfer that mortgage with the penalty being waived. Bottom point: I would sell when the condo is between 10-15 years old.

2. When the property is located in an area where population or job growth is declining. As investors, it is important to realize that the future of our real estate’s return on investment is highly dependent on the growth of jobs and population in the located area. As that thrives, the more valuable the property becomes. Comparatively, when the opposite happens, real estate prices decrease. It is wise to sell the property before we hear of a continued amount of job decreases and people moving away from the area in search of new occupations. That said, it is vital to remain up-to-date with the market(s) we’re investing in, and to really talk to the locals who live in that area and to sell before market downturns.

3. When you make over a 75% ROI (return on investment).

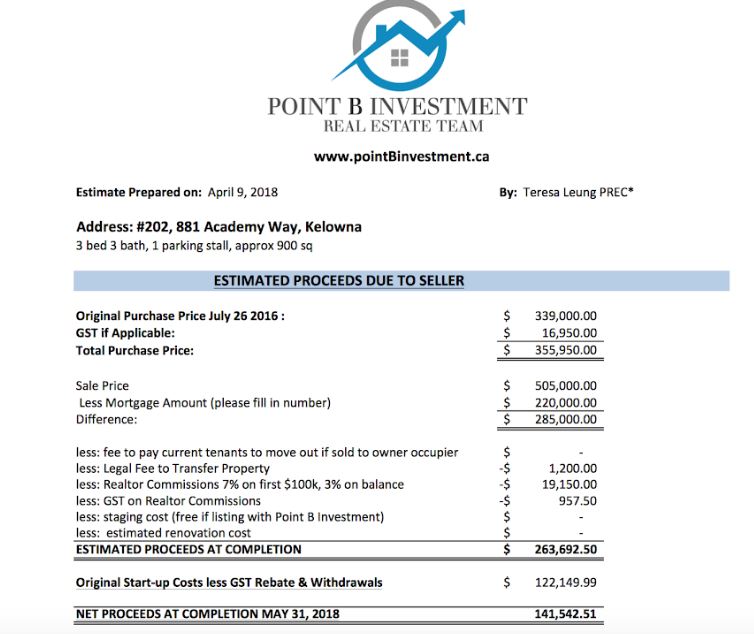

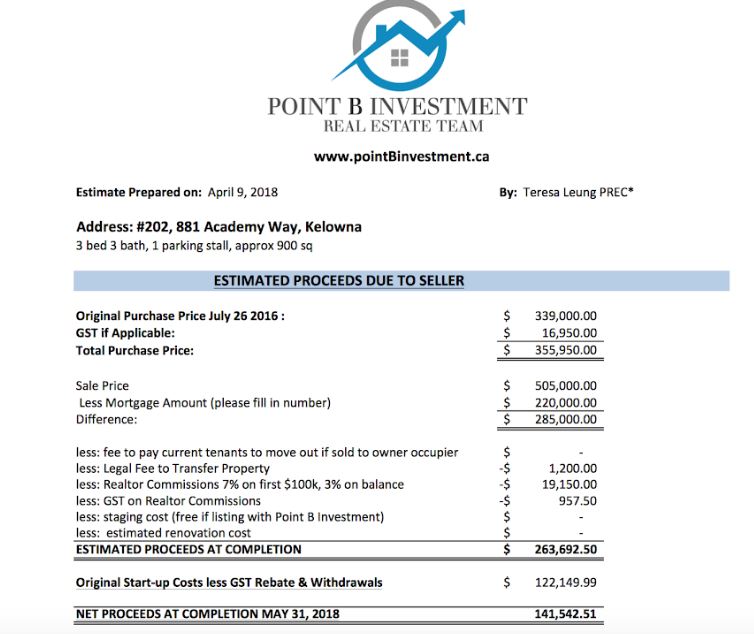

For example, in July 2016, nearly two years ago, I purchased a 3 Bedroom condo for $339,000 plus GST. It is located in the U-District of Kelowna, a five-minute walk across the Okanagan campus of the University of British Columbia. My initial cost for the property was $122,000 – which included my down payment, closing fees, and furnishings. Fast forward 22 months later, I sold the property for $505,000 (furniture included); the profit I received was $141,542 after paying off the mortgage, realtor fees, and closing costs – in other words, I made a 116% ROI all within this time span. It was a tough decision as my cash-flow was over $400/mth during the school year and up to $3000/mth during summertime. However, as great of an investment it was, I sold the property because I knew of more student rentals being built in the area, with many pending completion in one to two years from now. I also knew of the BC Government’s plan to create 5000 student rentals across BC, announced in the 2018 budget plan where they will dedicate increased spending on. Simply put, that meant more competition for student tenants, inevitably leading to me having to reduce my rental rates to compete and so I chose to exit the U-District area while it is still opportune.

As previously mentioned, it is essential to educate ourselves on the local market and upcoming changes that may affect real estate investment prices. It especially is useful when you also follow the 75% ROI Rule.

If you are thinking of selling your investment in Kelowna or anywhere else in BC, please contact us at teresa@pointbinvestment.ca or at (604)618-2128,

by Teresa Leung | May 6, 2018 | Real Estate Investing Tips

On April 19, after a long withstanding over short-term rentals, the city of Vancouver and Airbnb have come to an agreement permitting citizens to legally use their primary residences for short-term rentals. What used to be more lucrative for homeowners is now limited by the city bylaws that caps landlords to renting it for no more than thirty consecutive days. Through careful collaboration, the city aims to tackle the record-low vacancy rate, currently at 0.7 per cent by posing limitations on short-term rentals. Moreover, throughout this process, they hope to influence homeowners to make the shift from short-term rentals to long-term rentals.

If you decide to capitalize on operating short-term rentals in your (principal) home, you must acquire an annual business license; the fee for that is $49/year, with an additional one-time activation fee of $54. In addition to possessing the license, it is also necessary to feature it in every listed rental property on the global home-sharing site. Moreover, hosts are also to ensure they meet a checklist of requirements that can be found here. Failure to comply with the prerequisites results in daily fines of $1000 upwards. Undoubtedly a more meticulous process, but indefinitely a better alternative than being fined such amounts that would otherwise eat up your profitable cash flow!

by Teresa Leung | Apr 8, 2018 | Real Estate Investing Tips

With the deadline of the legalization of cannabis approaching us this summer, it is inevitable to think of what this may mean for Homeowners. The legislation of Bill C-45 enables individuals to engage in cultivating cannabis plants at home – depending on the circumstances, sizes of the plants and what type of residence, this could result in significant impacts in a home. Because of this, the Canadian Real Estate Association is working diligently to implement policies that will benefit buyers and sellers of homes alike and to not be left at a disadvantage.

With potentially drastic changes pending, we will be sure to update Investors on this matter as the legislation nears.